|

Download complete Ebook |

Table of Contents |

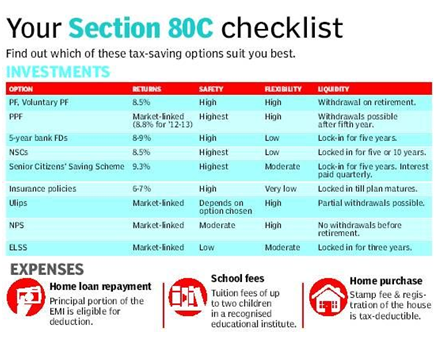

4. Deductions and Exemptions

Certain investments related expenditure are allowed to be deducted from the NET Income, upto a maximum if 1,00,000/- Rs

Source :Times of India – Guide to Income Tax planning

Also Read : Times of India – Tax Saving Goofups to avoid.

So, this puts forth our next task of listing out the deductions that are applicable to YOU.

Do pay attention to the options listed, and if need be, double / triple / quadruple check them before putting it down on your computation sheets. After all, it is your hard-earned-money, and you are eligible to keep every single paisa allowed on you.

|

TABLE 3 – Deductions |

|

| Deductions allowed from Gross Income. | |

| PPF Investments. | |

| NPS Investments. | |

| Insurance Policies Premium payments. | |

| Mutual Fund investments. | |

| NSC investments. | |

| NSS Investments. | |

| SCSS investments. | |

| Post Office/Tax saving Bonds investments. | |

| Children Tution Fees paid. | |

| Tax saving Fixed deposits for 5 yrs. | |

| Pension Fund (80 CCC) investments. | |

| Housing Loan – Principal portion of the EMI is eligible for deduction. | |

| Total deductions allowed in respect to 1 -12 is restricted to a combined total of ₹ 100000 /- only ..ie Rs 1 Lakh. |

|

| Total Amount 1 | |

| Housing loan interest upto ₹ 1,50,000 /- Rs is exempted. | |

| Total Amount 2 | |

| Other Deductions | |

| Medical treatment of self / dependents upto ₹ 40,000/- | |

| Interest on loan taken for pursuing higher studies. | |

| Donations to approved charitable institutions. | |

| Physically handicapped – ₹ 50,000 / – to ₹ 1,00,000/- depending on disability. | |

| Total Amount 3 | |

| Total amount deductible from Gross Income | Total Amount 1 + Total Amount 2 + Total Amount 3 |

Table of Contents |